Cook Islands Corporate Tax Rate . Web all newly incorporated ibcs after 17 december 2019 are required to meet the residency and tax obligations such as. Web the corporate income tax (cit) rate in the cook islands is 30% (the highest rate) and 20% (the lowest rate). Web the standard rate of corporate income tax in cook islands is 20%. Web average personal income tax and social security contribution rates on gross labour income table i.6. A resident domestic company is liable to pay 20% on its. The cook islands does not levy corporate income tax on companies operating within its. Web corporate income tax: Web revenue management division (rmd) is made up of the director’s office and support staff, corporate services, cook islands.

from www.americanthinker.com

Web corporate income tax: Web average personal income tax and social security contribution rates on gross labour income table i.6. Web revenue management division (rmd) is made up of the director’s office and support staff, corporate services, cook islands. The cook islands does not levy corporate income tax on companies operating within its. Web the standard rate of corporate income tax in cook islands is 20%. Web all newly incorporated ibcs after 17 december 2019 are required to meet the residency and tax obligations such as. Web the corporate income tax (cit) rate in the cook islands is 30% (the highest rate) and 20% (the lowest rate). A resident domestic company is liable to pay 20% on its.

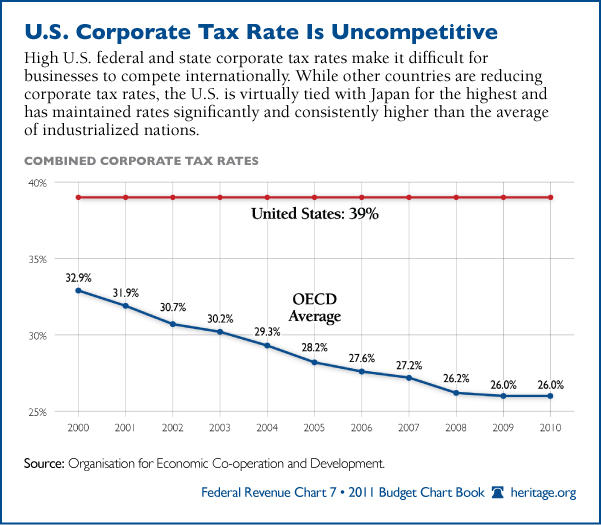

US now has highest corporate tax rates in the world American Thinker

Cook Islands Corporate Tax Rate The cook islands does not levy corporate income tax on companies operating within its. Web average personal income tax and social security contribution rates on gross labour income table i.6. Web corporate income tax: Web revenue management division (rmd) is made up of the director’s office and support staff, corporate services, cook islands. Web all newly incorporated ibcs after 17 december 2019 are required to meet the residency and tax obligations such as. A resident domestic company is liable to pay 20% on its. Web the corporate income tax (cit) rate in the cook islands is 30% (the highest rate) and 20% (the lowest rate). Web the standard rate of corporate income tax in cook islands is 20%. The cook islands does not levy corporate income tax on companies operating within its.

From www.taxpolicycenter.org

How do US taxes compare internationally? Tax Policy Center Cook Islands Corporate Tax Rate A resident domestic company is liable to pay 20% on its. Web corporate income tax: Web the standard rate of corporate income tax in cook islands is 20%. Web the corporate income tax (cit) rate in the cook islands is 30% (the highest rate) and 20% (the lowest rate). The cook islands does not levy corporate income tax on companies. Cook Islands Corporate Tax Rate.

From www.greenbacktaxservices.com

Where will you pay the most in corporate tax? Cook Islands Corporate Tax Rate Web the standard rate of corporate income tax in cook islands is 20%. Web average personal income tax and social security contribution rates on gross labour income table i.6. Web corporate income tax: Web the corporate income tax (cit) rate in the cook islands is 30% (the highest rate) and 20% (the lowest rate). Web all newly incorporated ibcs after. Cook Islands Corporate Tax Rate.

From marketbusinessnews.com

Corporation tax definition and meaning Market Business News Cook Islands Corporate Tax Rate Web the standard rate of corporate income tax in cook islands is 20%. Web all newly incorporated ibcs after 17 december 2019 are required to meet the residency and tax obligations such as. A resident domestic company is liable to pay 20% on its. Web corporate income tax: Web average personal income tax and social security contribution rates on gross. Cook Islands Corporate Tax Rate.

From paulirosemary.pages.dev

Tax Brackets 2024/25 Uk Lorna Rebecca Cook Islands Corporate Tax Rate Web the standard rate of corporate income tax in cook islands is 20%. Web average personal income tax and social security contribution rates on gross labour income table i.6. Web revenue management division (rmd) is made up of the director’s office and support staff, corporate services, cook islands. A resident domestic company is liable to pay 20% on its. Web. Cook Islands Corporate Tax Rate.

From taxfoundation.org

The U.S. Has the Highest Corporate Tax Rate in the OECD Cook Islands Corporate Tax Rate Web average personal income tax and social security contribution rates on gross labour income table i.6. The cook islands does not levy corporate income tax on companies operating within its. Web revenue management division (rmd) is made up of the director’s office and support staff, corporate services, cook islands. Web the corporate income tax (cit) rate in the cook islands. Cook Islands Corporate Tax Rate.

From www.familysearch.org

FileCook Islands, Civil Registration, 18461989 dgs008082369 image10 Cook Islands Corporate Tax Rate Web corporate income tax: Web revenue management division (rmd) is made up of the director’s office and support staff, corporate services, cook islands. Web the standard rate of corporate income tax in cook islands is 20%. The cook islands does not levy corporate income tax on companies operating within its. Web all newly incorporated ibcs after 17 december 2019 are. Cook Islands Corporate Tax Rate.

From marketbusinessnews.com

Corporation tax definition and meaning Market Business News Cook Islands Corporate Tax Rate Web revenue management division (rmd) is made up of the director’s office and support staff, corporate services, cook islands. A resident domestic company is liable to pay 20% on its. Web all newly incorporated ibcs after 17 december 2019 are required to meet the residency and tax obligations such as. Web the corporate income tax (cit) rate in the cook. Cook Islands Corporate Tax Rate.

From taxfoundation.org

The Benefits of Cutting the Corporate Tax Rate Tax Foundation Cook Islands Corporate Tax Rate Web the corporate income tax (cit) rate in the cook islands is 30% (the highest rate) and 20% (the lowest rate). Web average personal income tax and social security contribution rates on gross labour income table i.6. A resident domestic company is liable to pay 20% on its. Web revenue management division (rmd) is made up of the director’s office. Cook Islands Corporate Tax Rate.

From www.weforum.org

Which countries tax their citizens the most? World Economic Forum Cook Islands Corporate Tax Rate Web the standard rate of corporate income tax in cook islands is 20%. Web all newly incorporated ibcs after 17 december 2019 are required to meet the residency and tax obligations such as. A resident domestic company is liable to pay 20% on its. Web revenue management division (rmd) is made up of the director’s office and support staff, corporate. Cook Islands Corporate Tax Rate.

From www.ciic.gov.ck

Bank of the Cook Islands (BCI) Cook Islands Investment Corporation (CIIC) Cook Islands Corporate Tax Rate Web the corporate income tax (cit) rate in the cook islands is 30% (the highest rate) and 20% (the lowest rate). Web average personal income tax and social security contribution rates on gross labour income table i.6. Web corporate income tax: Web revenue management division (rmd) is made up of the director’s office and support staff, corporate services, cook islands.. Cook Islands Corporate Tax Rate.

From www.investmentwatchblog.com

Visualizing Global Corporate Tax Rates Around the World Investment Watch Cook Islands Corporate Tax Rate Web average personal income tax and social security contribution rates on gross labour income table i.6. Web corporate income tax: The cook islands does not levy corporate income tax on companies operating within its. Web the standard rate of corporate income tax in cook islands is 20%. A resident domestic company is liable to pay 20% on its. Web revenue. Cook Islands Corporate Tax Rate.

From www.statista.com

Chart Global Corporation Tax Levels In Perspective Statista Cook Islands Corporate Tax Rate A resident domestic company is liable to pay 20% on its. Web corporate income tax: Web the standard rate of corporate income tax in cook islands is 20%. Web average personal income tax and social security contribution rates on gross labour income table i.6. Web all newly incorporated ibcs after 17 december 2019 are required to meet the residency and. Cook Islands Corporate Tax Rate.

From www.dreamstime.com

The Cook Islands Trading Corporation Store in Avarua, Rarotonga Cook Islands Corporate Tax Rate Web the corporate income tax (cit) rate in the cook islands is 30% (the highest rate) and 20% (the lowest rate). A resident domestic company is liable to pay 20% on its. Web revenue management division (rmd) is made up of the director’s office and support staff, corporate services, cook islands. Web all newly incorporated ibcs after 17 december 2019. Cook Islands Corporate Tax Rate.

From taxfoundation.org

Corporate Tax Rates Around the World Tax Foundation Cook Islands Corporate Tax Rate Web average personal income tax and social security contribution rates on gross labour income table i.6. A resident domestic company is liable to pay 20% on its. Web the corporate income tax (cit) rate in the cook islands is 30% (the highest rate) and 20% (the lowest rate). Web all newly incorporated ibcs after 17 december 2019 are required to. Cook Islands Corporate Tax Rate.

From ck.icalculator.com

Cook Islands Annual Tax Calculator 2022 Annual Salary After Tax Cook Islands Corporate Tax Rate Web revenue management division (rmd) is made up of the director’s office and support staff, corporate services, cook islands. The cook islands does not levy corporate income tax on companies operating within its. Web average personal income tax and social security contribution rates on gross labour income table i.6. Web the corporate income tax (cit) rate in the cook islands. Cook Islands Corporate Tax Rate.

From banknotehub.com

COOK ISLANDS 3 DOLLARS 1992 P7a UNC BANKNOTEHUB Cook Islands Corporate Tax Rate Web the standard rate of corporate income tax in cook islands is 20%. A resident domestic company is liable to pay 20% on its. Web revenue management division (rmd) is made up of the director’s office and support staff, corporate services, cook islands. Web corporate income tax: Web all newly incorporated ibcs after 17 december 2019 are required to meet. Cook Islands Corporate Tax Rate.

From www.ciic.gov.ck

Infrastructure Secreteriat Cook Islands Investment Corporation (CIIC) Cook Islands Corporate Tax Rate A resident domestic company is liable to pay 20% on its. The cook islands does not levy corporate income tax on companies operating within its. Web the corporate income tax (cit) rate in the cook islands is 30% (the highest rate) and 20% (the lowest rate). Web all newly incorporated ibcs after 17 december 2019 are required to meet the. Cook Islands Corporate Tax Rate.

From wiiw.ac.at

The push for a global minimum corporate tax rate (news article) Cook Islands Corporate Tax Rate Web the corporate income tax (cit) rate in the cook islands is 30% (the highest rate) and 20% (the lowest rate). A resident domestic company is liable to pay 20% on its. Web the standard rate of corporate income tax in cook islands is 20%. Web all newly incorporated ibcs after 17 december 2019 are required to meet the residency. Cook Islands Corporate Tax Rate.